Swing Spot Trading can be a useful strategy for students interested in trading financial markets, such as forex, stocks, or cryptocurrencies. Swing trading involves holding positions for a few days to weeks, aiming to capture short-to-medium-term price movements. Here’s a step-by-step guide on how students can use swing spot trading effectively:

1. Understand the Basics of Swing Trading

- Definition: Swing trading involves buying and selling financial assets based on short-to-medium-term price swings. Unlike day trading, swing traders hold positions for days or weeks.

- Market Selection: Swing trading can be applied to various markets like forex, stocks, commodities, or cryptocurrencies. Choose a market you’re comfortable with and have access to.

- Time Commitment: As a student, you need to balance trading with studies. Swing trading requires less time than day trading but still needs regular monitoring.

2. Set Up a Trading Account

- Choose a Broker: Select a reliable broker that offers spot trading in your chosen market. Look for low fees, a user-friendly platform, and educational resources.

- Demo Account: If you’re new, start with a demo account to practice without risking real money. This helps you understand how the market moves and test your strategies.

- Funding: Once you’re confident, fund your account with an amount you can afford to lose. As a student, start small and avoid over-leveraging.

3. Develop a Trading Strategy

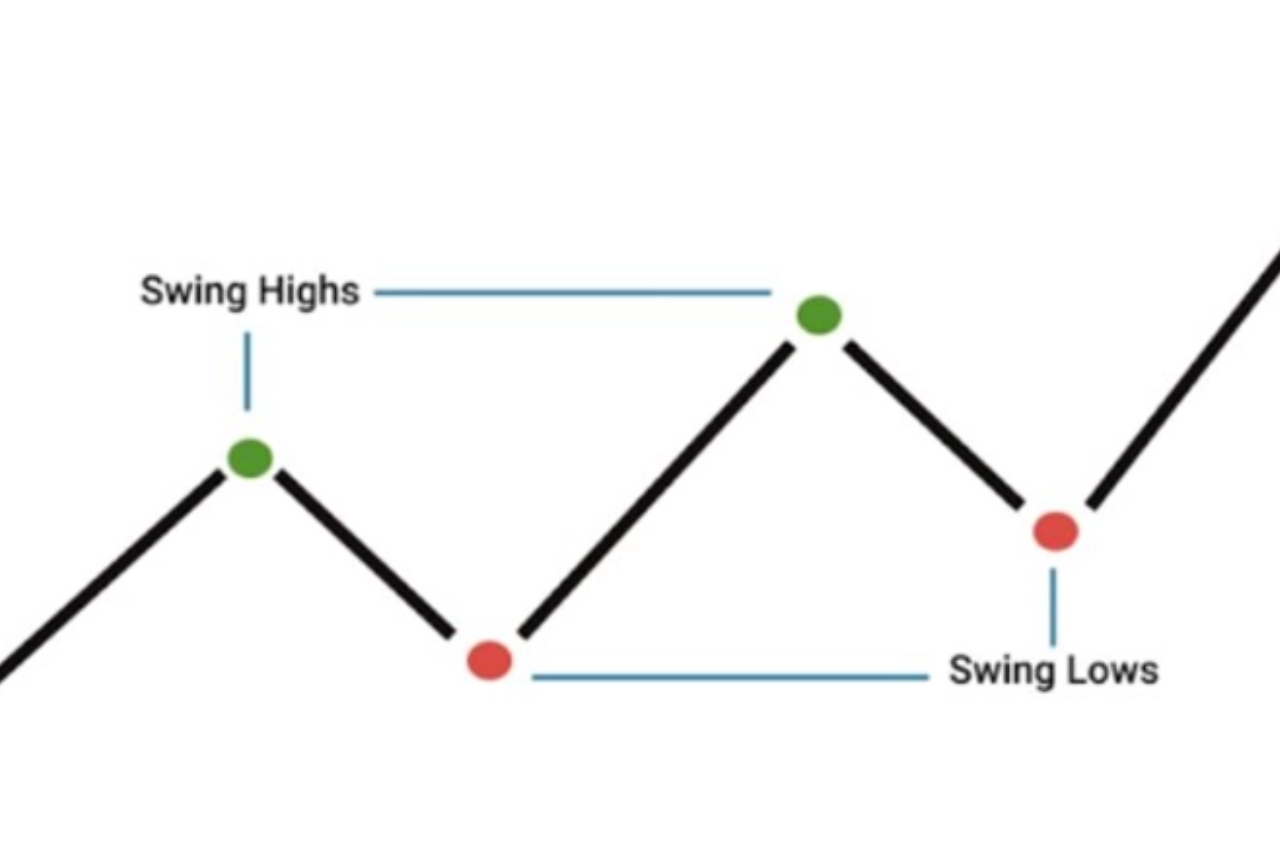

- Technical Analysis: Swing traders rely heavily on technical analysis. Learn to read charts, identify trends, and use indicators like moving averages, RSI, MACD, and Bollinger Bands.

- Entry and Exit Points: Define clear rules for entering and exiting trades. For example, you might buy when a stock breaks above a resistance level and sell when it reaches a predetermined profit target or hits a stop-loss.

- Risk Management: Always use stop-loss orders to limit potential losses. Risk only a small percentage of your capital on each trade (e.g., 1-2%).

4. Monitor the Market

- Daily Review: Spend a few minutes each day reviewing your open positions and the overall market. Look for new trading opportunities based on your strategy.

- News and Events: Keep an eye on economic news, earnings reports, or geopolitical events that could impact the market. For example, in forex, central bank decisions can cause significant price swings.

5. Execute Trades

- Entry: Once you’ve identified a trade setup, execute the trade according to your strategy. For example, if you’re trading forex, you might buy USD/EUR if it breaks above a key resistance level.

- Exit: Close the trade when your profit target is reached or if the market moves against you (based on your stop-loss).

6. Evaluate and Improve

- Review Trades: After each trade, review what went right or wrong. Did you follow your strategy? What can you improve?

- Learn from Mistakes: Trading is a learning process. Analyze your mistakes and adjust your strategy accordingly.

7. Balance Trading and Studies

- Time Management: As a student, prioritize your studies. Set specific times for trading and avoid letting it interfere with your academic responsibilities.

- Stay Disciplined: Stick to your trading plan and avoid emotional decisions. Don’t trade with money you can’t afford to lose.

8. Stay Educated

- Continuous Learning: Trading is a skill that requires ongoing education. Read books, take online courses, and follow market news to improve your knowledge.

- Join Communities: Engage with other traders in online forums or social media groups. Sharing insights and experiences can help you grow as a trader.

9. Tax and Legal Considerations

- Taxes: Be aware of the tax implications of trading in your country. Keep records of all your trades for tax purposes.

- Regulations: Ensure you’re complying with local laws and regulations related to trading.

Example Scenario for a Swing Trade:

- Market: Forex

- Currency Pair: EUR/USD

- Setup: The EUR/USD has been in an uptrend and recently pulled back to a key support level. You decide to go long (buy) based on technical indicators like the RSI showing oversold conditions.

- Entry: Buy at 1.1200

- Stop-Loss: Place a stop-loss at 1.1150 to limit your risk.

- Take-Profit: Set a take-profit at 1.1300 based on previous resistance levels.

- Outcome: The price rises to 1.1300, and you close the trade with a profit.

Key Takeaways for Students:

- Start Small: Begin with a small amount of capital and gradually increase as you gain experience.

- Practice First: Use a demo account to practice your strategies without financial risk.

- Stay Disciplined: Stick to your trading plan and avoid emotional decisions.

- Balance Responsibilities: Ensure that trading doesn’t interfere with your studies or other commitments.

By following these steps, students can effectively use swing spot trading to potentially grow their capital while managing their academic responsibilities.

See more: Spot trading vs futures trading for students in cryptocurrency